Do you have a more important asset than your income? Is it protected?

Why do I need Income Protection?

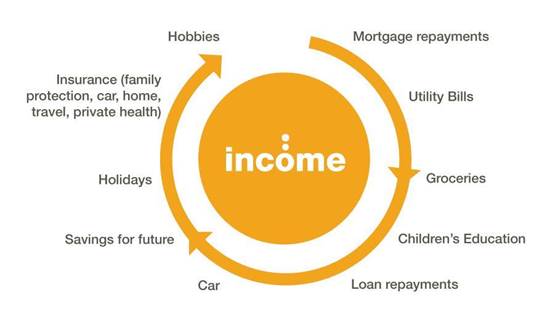

Your income is your most important asset, it is the glue of your finances. If you have a family, their financial well-being and lifestyle may also be dependent on it. While assets such as your home and your car are insured, insuring your income means insuring yourself against the risk of not being able to work long term. If you’re unable to work long term, how would your finances and lifestyle alter? While, your monthly income may stop your costs and bills won’t, such as mortgage repayments. Are your savings enough to alleviate the financial pressure as a result of your inability to work due to injury or illness?

What about State Aid?

If you’re unable to work long term, how would your finances and lifestyle alter? While, your monthly income may stop your costs and bills won’t, such as mortgage repayments. If you’re self-employed Income Protection is of vital importance, there is no safety net. You do not qualify for State Illness Benefit.

If you’re employed and unable to work, you will be able to avail of the State Illness Benefit but it is 10,556 a year for 2 years, would this be sustainable? This becomes an even bigger concern if as mentioned above others depend on your income, you may be the sole or main earner and your family may depend on your income. Your income provides the requisite funds to maintain your other assets, your house, your car and other consistent expenses. Therefore it makes perfect sense to put an insurance policy in place to protect this asset, an Income Protection Policy.

How does Income Protection Work?

If you take out an Income Protection Policy, you can insure up to 75% of your salary less State Illness Benefit if you’re eligible if you’re unable to work for a certain period of time. This period of time is known as your deferral period, can vary from 8 weeks to 52 weeks. For example, you chose 26 weeks is a common deferral period. So if you suffered an injury or were diagnosed with an illness and were unable to work for a period of 26 weeks, after this period your Income Protection would start paying 75% of your salary monthly or weekly.

What happens if I cannot return to work?

If you’re unable to go back to work again your policy will pay you an income up until your chosen retirement age when you set up the policy, for example 65 with the maximum retirement age that you can choose being 70. The policy can be a financial life line and provide total financial peace of mind, to allow you to focus on getting better without the added stress of financial pressure. Insure your income insure yourself against illness or injury or the inability to work.

What does it cost?

Income Protection can be an expensive product there is no doubt. However can you afford not to have it? Logically the life company are open to the payment of a considerable claim if you cannot work long term. A huge plus side on the cost of Income Protection is the tax relief. If you pay tax at the higher rate, you can claim 40% tax relief on your Income Protection policy, the same applies if you’re on the normal rate, you can claim 20% tax relief.

The cost of your Income Protection policy will vary based on age, benefit chosen, occupation and deferral period chosen. Certain occupations are classed as a higher risk, therefore a higher premium will be charged to a person working in a more dangerous job. If cost is a barrier, you may just want to insure a portion of your income, or why not insure your mortgage repayments, if you’re unable to work. At least it is the main cost/ worry covered if you’re unable to work and earn an income. It’s vital to have some form of Income Protection.

Is it difficult to get accepted for Income Protection?

Income Protection is underwritten quite strictly. If you’re in good health, getting acceptance terms should not be difficult. However if you have an existing medical issue or complication, it may prove difficult, but we help clients with medical issues apply for cover to get them the best possible protection available. Thorough underwriting and full disclosure of all relevant facts is essential to ensure if you do need to claim on your policy that the claim process is seamless. This is imperative, as if you’re unable to work you want your policy which you have paid for to pay out without any issue and provide much needed financial peace of mind. Certain occupations will not be able to obtain Income Protection cover.

Talk to us about your Income Protection Needs

Here at Niall G Lynch Insurance Brokers, we help you achieve your financial goals through tailored financial planning and guidance. While advising you that it is crucial to put provisions in place to protect yourself against risks posed to you achieving those goals. As outlined above, the glue of your financial plans is your income, therefore can you afford not to have it protected?

Income Protection can be an expensive product there is no doubt. However can you afford not to have it? Logically the life company are open to the payment of a considerable claim if you cannot work long term. A huge plus side on the cost of Income Protection is the tax relief. If you pay tax at the higher rate, you can claim 40% tax relief on your Income Protection policy, the same applies if you’re on the normal rate, you can claim 20% tax relief.

If you would like further information on Income Protection Planning please contact us today to get a free consultation.

Dylan has been working in Financial Services for the last 4 years and also has a background in law. He is a financial planner with Niall G Lynch Insurance Brokers dedicated to delivering on the brokerages ethos of client focused financial planning and guidance.

Dylan has been working in Financial Services for the last 4 years and also has a background in law. He is a financial planner with Niall G Lynch Insurance Brokers dedicated to delivering on the brokerages ethos of client focused financial planning and guidance.

Recent Comments