Financial Advice Blog

Welcome to our financial advice blog. This part of our website is packed with information for you, your family and your business. We share jargon free tips regularly here on our blog and on social media.

Your Financial Planner

Have you ever wondered what a pension is? Do you understand life cover and insurance? Are you a small business owner who does not have cover in place for your family? Do you know what income protection is? These are all topics that I explain in our financial advice blog. I use plain english to describe complex topics so that you can understand the best protection for you. I am Dylan Lynch and I am your financial planner.

Our Latest Financial Advice Blog Posts:

Building your Financial Protection Portfolio

Building Your Protection Portfolio Protection and insurance are aspects of Financial Planning, which people can find uninteresting, confusing, and expensive. Protection planning does not come across as attractive in comparison to, investing and pension funding, to...

The Importance of Insuring The Human Assets & Legacy of Your Business – Business Protection

Introduction to Business Protection Proper contingency planning is a process which can make a business more robust in the face of a serious unforeseen or challenging event, which could pose a threat to the business. Business Insurance, which comes in many forms is an...

Whole of Life Continuation Benefit – Unrivalled Clarity, Longevity and Value in Life Assurance

Introduction Finance news today: Properly assembled Life Assurance is at the heart of prudent financial planning. There may be different motivations for taking out life cover, family protection when a couple's children are young, to cover borrowings, to leave behind a...

Putting an action plan around your Savings, with a Regular Savings Plan

The Value of Savings Saving is an invaluable habit. It is a discipline which can be crucial to the achievement of our financial goals and preservation of our overall financial well-being. Saving may not always be an option, depending on what point we are at in life....

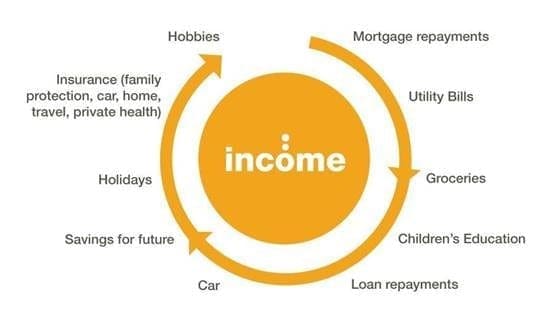

Have you protected your most important asset? Your Income

Have you protected your most important asset? Your Income Aims of this Piece This article aims to discuss, what Income Protection is as a plan and its merits and unrivalled protection, and reinforce 3 main points; 1. The role your income has your most important...

Business Protection, it should be part of every Business Plan

What does Business protection entail? Business protection means putting protective provisions in place to protect a company and its various stakeholders from financial shocks as a result of something happening to the human assets of the business. This article seeks to...

Transferring Assets During Life – Funding for Potential Gift Tax Liability

Forward thinking Financial & Estate Planning Following on from the theme of my previous article this piece also focuses on the link between financial planning and estate planning. The benefit of prudent financial and estate planning can have the dual effect of...

Forward thinking Financial & Estate Planning

Introduction - The many purposes for Life Insurance Life Insurance/ Life Cover can be taken out for various reasons and to protect against and plan for a variety of scenarios, as a result of the death of the life assured. Often people are unaware of the value of Life...

Mortgage Protection – Best Practice – Joint Life vs Dual Life

A Mortgage Protection policy is often a time-sensitive policy, people want to get it in place ASAP to draw down their mortgage. It means that you have a policy to clear your mortgage in the event of the death of you or your partner. The life cover decreases in line...

Specified Illness Cover; a Vital Protection Product is set for a Price Increase

How does a Specified Illness policy work? Being diagnosed with a Serious Illness is a risk we are all exposed to. Unfortunately, rates of diagnosis are on the rise. This diagnosis can be life-altering in many ways. A very common issue for people is increased financial...

Would you like help?

We are happy to answer any queries you might have in relation to financial planning here in our blog. If you want to ask a question in relation to a topic raised in our blog then please submit a comment or email us your question today. Alternatively if you would like a new topic explored then please let us know by email via the contact from below. I look forward to answering your queries.

Book your FREE consultation

We offer a variety of services to suit your needs at different stages of your life. Income protections, life and family insurance, business finance planning and pension schemes.

Book your free consultation by calling or messaging us today.

Contact

Get In Touch

090 647 8503

info@yourfinancialplanner.ie

Castlemaine St,

Ankers Bower,

Athlone,

Co. Westmeath

Opening Hours

Mon-Fri: 9am-5pm