Have you protected your most important asset? Your Income

Aims of this Piece

This article aims to discuss, what Income Protection is as a plan and its merits and unrivalled protection, and reinforce 3 main points; 1. The role your income has your most important asset. 2. The importance of insure this asset and in doing so, insure yourself 3. The way an Income Protection plan works and its recommended place as a top priority in your overall financial planning. I will also aim to cover frequently asked questions of Income Protection, ensuring clarity on its terms and conditions and discuss, its unique nature and its difference to many sick pay arrangements. Our ethos and goal at Niall G Lynch Insurance Brokers is to provide client focused tailored advice on various protection plans, which aim to provide financial peace of mind in you or your families most troubling times. Income Protection is arguably the most important protection plan to have in place, in terms of the protection it provides against the possible adverse effects to your financial wellbeing, if you’re unable to work due to accident, injury or illness if it is not in place.

What is Income Protection & why is it important?

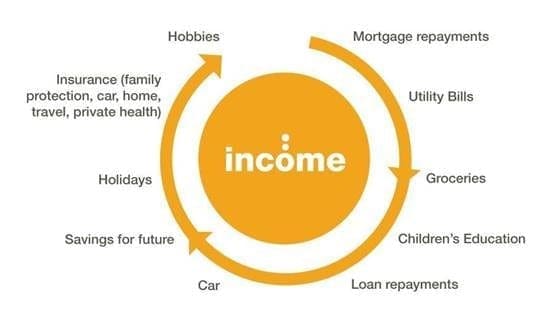

Your financial well-being and if you have a family, that of your families is predicated on the ability to earn an income. What would the scenario look like if your ability to earn an income was to cease, due to an inability to work. Your income may stop, but your bills and outgoings will not. The fixed bills such as utilities, mortgage and loan repayments would continue to be payable. An income protection policy can provide a financial cushion for you and your loved ones in this stressful scenario. The aim of this policy is to pay you a regular income to safeguard your financial well-being and lifestyle until you’re capable of going back to work.

An Income Protection plan can pay you up to 75% of your income less social welfare entitlements as an income replacement, if you’re unable to work due to accident/injury or illness. You must be unable to work for your deferral period on the policy before a claim is payable. This ranges from 4 to 52 weeks, the shorter the deferral period, the higher the premium. So if you have a 13 week deferral period and you’re unable to work and medical evidence supports this your claim would be payable after the 13 weeks have elapsed. It can provide you with this income while you’re unable to work and provide a much needed financial lifeline or cushion. If you continue to be unable to return to work and medical evidence supports this, your income protection plan will continue to pay you an income, up until chosen retirement age on the policy, max being age 70. Therefore there is a longevity aspect to Income Protection. If you need this policy for a short term period of inability to work or for the longer term it covers both scenarios. In the unfortunate scenario that you’re unable to work indefinitely this policy will continue to provide a vital source of income, to at least go some way to alleviating financial worries during such a demanding period. The plan involves protecting your ability to earn, if that ability is adversely affected long term your policy provides the financial buffer to take the time to recover. This is the core of the point, your Income Protection Plan provides the financial peace of mind so recovery from an illness whether mental or physical or an accident or injury is your focus. Making sure, financial worries are not another layer during an already distressing time. We insure our houses, our cars and many of our other assets. However our income maintains these assets, the running of a household the running of a car and payment of loans related to these, etc. An Income Protection policy protects your most important asset, it makes sense to insure yourself as an income earner. There is also tax relief on the premiums which is welcome, at your rate of income tax.

Where should Income Protection rank in my overall Financial Plan?

You may already have certain protection plans in place such as, mortgage protection, life assurance or possibly specified illness. The term portfolio is used frequently in an investment context. It is stressed how important it is to have a diversified portfolio so all of your money/fund is not exposed to one risk. This logic applies to your protection plans. A well-established and diversified protection portfolio should be at the core of your financial planning. A protection portfolio means protecting yours or your family’s financial well-being from a variety of risks that are posed to it. The main risks are the inability to work and earn, diagnosis of an illness or premature death

Protection plans are routinely taken out to cover against premature death. Mortgage Protection is taken to clear off your mortgage in the event of your death or Life Assurance to leave a lump sum to your partner or family in the event of your premature death, to replace some level of your income or earning potential. However statistically you’re far more likely to be unable to work for a period of time in your life than to die prematurely. Mortgage Protection & Independent Life Assurance are vital aspects to your protection portfolio but having these in place with an absence of Income Protection means you and your financial well-being are exposed to the risk of being unable to work due to accident injury or illness. You have a mortgage protection policy, a policy to make sure you’re able to maintain those mortgage repayments if you’re unable to work is just as important to have.

These plans only cover you if you pass away, income protection provides a living benefit. An Income Protection plan as outlined above can mean there is an income there to maintain mortgage repayments, for a short term period off work or a prolonged period. Therefore a well-balanced protection portfolio, within your budget provides superior overall protection against multiple risks posed to your financial well-being.

Specified Illness Cover is another common protection plan and it can often be compared to Income Protection. The 2 policies are completely different. In terms of what is covered, a specified illness policy only covers diagnosis of a physical illness which must meet the definitions of your plan. In the case of a successful claim you get a one off lump sum payment 14 days after diagnosis. Specified Illness Cover can provide true value as an injection of funds to help you have financial peace of mind post diagnosis and through the relevant treatment/recovery phase. However it does not provide an income payment it is a lump sum. Once you have fully claimed off it the policy ends, it does not remain in place like Income Protection in the case of a relapse for example. The policy does not cover accident or injury or mental health issues such as anxiety or depression. Specified Illness Cover certainly has its place in a protection portfolio, but in terms of longevity and cover Income Protection provides superior protection.

Income Protection provides superior cover to anything else available on the market. It covers accident, injury and both mental health and physical health. Both what it covers and the extent of the benefit it provides make it a major priority in a person’s overall financial planning and should form the core of their protection portfolio. It involves protecting your most important asset and in doing so your financial wellbeing and lifestyle. You can have a multitude of claims with Income Protection, so if you relapse for example and are unable to work your policy will pay out again after a certain, period, if medical evidence supports this. There can be multiple claims on an Income Protection Plan. It is not a one off payment, after you return to work you still have an Income Protection policy if as described you relapse or if you’re unable to work in the future. So even if you have claimed off Income Protection and you recover and return to work, you will still have Income Protection.

Ensuring Clarity on the terms and conditions of Income Protection

Total clarity on an Income Protection plan and its terms and conditions is especially important when considering taking out Income Protection. This ensures the key principle of – knowing what you own why you own it. Below are the 4 main terms & factors of Income Protection.

1. Medical Underwriting – This is a stringently underwritten policy, due to the level of risk the Life Company is taking on. It may not be available to people with certain conditions, however we would strive to get the best possible underwriting scenario, but in some cases Income Protection will not be available.

2. Calculation of Benefit – The maximum amount of your income that you can protect is 75%. If you’re self-employed this is 75% of you income. If you’re employed the maximum benefit you can protect is 75% of your salary less social welfare entitlements of 10,569. This is the financial underwriting aspect of the policy. In the event of a claim, this income must be proved. 75% is the maximum amount of your income you can insure but it may be an idea tojust insure a certain portion if that is within your budget.

3. Deferral Period – This is a vital term to understand in Income Protection. This is the period you must be unable to work before your Income Protection policy will begin to pay out. The options range from 4 weeks to 52 weeks. The shorter deferral period chosen the higher the premium charged. It is important that there is harmony between your circumstances and the deferral period chosen. For example if you have sick pay at work which covers your full salary for 6 months, then your income protection policy should have a 26 week deferral period to coincide with this. There is no point having an 8 or a 13 week deferral period in this scenario, as the policy would not pay-out as you’re in receipt of income via sick pay. So you would be paying a higher premium unnecessarily. Dove-tailing your income protection deferral period with your sick pay arrangements means you have cover past that 6 months if needed but also that you’re maximising value in the premium you’re paying. Whereas if you’re self-employed and have no safety net, a considerably shorter deferral period would be more appropriate, to ensure adequate cover. I cannot stress the importance of your protection plans being tailored to your financial circumstances, to ensure certainty and clarity which are especially important if you need to claim. The claim process needs to be seamless as it will be occurring through an undoubtedly troubling time.

4. Term Chosen – You can take out your Income Protection Policy to run up until your 70th birthday. Common ages chosen include 60 and 65 to coincide with retirement age. As discussed if you’re unable to work and out on an Income Protection claim and medical evidence supports you’re unable to return to work, the policy will pay you an income right up to the chosen term age. You may choose 60 at the outset and down the line wish to extend to 65, to do this you will have to go through full underwriting and will be charged the premium for your age at that time.

Understanding and having clarity on your workplace benefits

A reason for not taking out income protection for some people may be that they have sick pay at work. But what are the terms of this sick pay and does it provide adequate cover for a long term recovery and inability to work. Some companies and employers provide Income Protection for their employees, which is an excellent added benefit to be provided. However some employers may provide sick pay as discussed. Clarity on the terms of your sick pay arrangements is massively important. While a common arrangement we see is full pay for six months and half pay for the next 6 or just full or half pay for 6 months. I return to the earlier point of the longevity of Income Protection and also how your plan should be tailored to your financial circumstances.

Let’s take a scenario, a person who has full sick pay for 6 months. They suffer a severe accident/injury and their prognosis is that they will be unable to work long term possibly not again. Their sick pay will cover them for 6 months, but after that they would likely have to rely on social welfare. However if they had an income protection policy in place with a 26 week deferral period, when their sick pay would stop, their income protection policy would begin to pay-out and continue to pay them up to 75% of their salary, while they’re unable to work. When thinking about Income Protection and your sick pay arrangements, please make sure you’re comparing like with like. One may be a short term payment while one could pay you an income while you’re unable to work and still be in place if you have a relapse in the future to the same.

Income Protection for the Self Employed – A necessity not discretionary

While above I discussed marrying your Income Protection plan with your sick pay arrangements to maximise value & protection. For a self-employed person, there is no safety net. Be it from sick pay or social welfare, that’s why Income Protection is of paramount importance for the self-employed. As in a lot of cases if you’re self-employed, you’re the business. If you were unable to work and generate revenue due to accident/injury or illness, how long could you receive an income from the business? Putting in place a policy protecting a percentage of your earnings is really a no brainer. Income Protection involves protecting and insuring yourself. As a self-employed person you have insurance in place on the assets of the business building, vehicles if applicable but have you insured the most important asset, yourself?

Concluding Note

The aim of this article is to inform those out there who are engaged in financial planning or not engaged or thinking about engaging that your ability to earn is your single greatest asset. The achievement of your financial goals and maintenance of financial well-being is predicated upon it. As you progress in your life, to renting, buying a home potentially having a family, this ability to earn an income and what it supports grows in importance. Therefore, putting a plan in place to protect this asset and in doing so protecting yourself, and possibly your family makes sense. If you would like to hear more about this plan or discuss other areas of financial planning, please don’t hesitate to make contact with us, via phone, email or on our website. Please contact us via our Contact Page Here In this time, we hope that everyone and their loved ones are keeping safe and well during the Covid-19 pandemic.

Dylan has been working in Financial Services for the last 4 years and also has a background in law. He is a financial planner with Niall G Lynch Insurance Brokers dedicated to delivering on the brokerages ethos of client focused financial planning and guidance.

Dylan has been working in Financial Services for the last 4 years and also has a background in law. He is a financial planner with Niall G Lynch Insurance Brokers dedicated to delivering on the brokerages ethos of client focused financial planning and guidance.

Recent Comments